Marquess Core AI Promises 700% Returns, 1000% Vibes

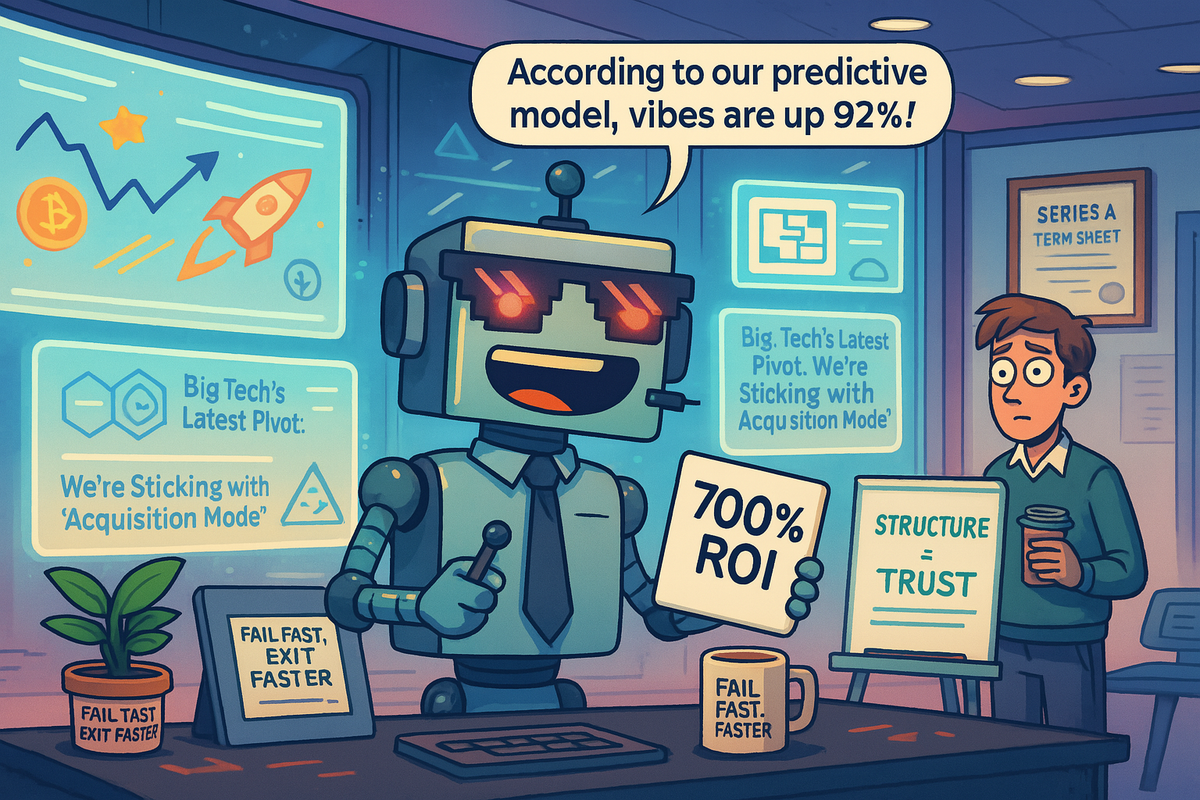

Marquess School Global claims its new Core AI can deliver 700% crypto returns with radical transparency—because nothing says trust like algorithmic fortune-telling.

In today’s edition of “What If ChatGPT Ran Your Hedge Fund,” a company called Marquess School Global Ltd has stepped forward to announce its flagship product: Marquess Core AI, an artificial intelligence tool that allegedly makes Wall Street look like a lemonade stand.

At first glance, the name sounds less like a financial powerhouse and more like a boarding school for kids who didn’t make the cut at Eton. But Marquess insists it’s not in the business of issuing report cards. Instead, it wants to manage your crypto portfolio and maybe, just maybe, turn your spare change into a private jet.

The company, founded in 2019 and allegedly headquartered in Singapore, describes itself as a pioneer in something called “structured investing.” That’s a phrase broad enough to mean anything from careful portfolio diversification to throwing a neural network at 1,200 data feeds and hoping it doesn’t accidentally dump your life savings into WeWork stock.

Marquess Core AI: 92% Accuracy and 700% Returns

According to today’s announcement, Core AI boasts 92% prediction accuracy—just a smidge shy of Nostradamus, but significantly better than your uncle’s stock tips. It also performs millisecond-level trades, which makes it perfect for outpacing your cousin’s Robinhood account and ensuring you lose money faster than humanly possible.

But the real kicker? Marquess claims Core AI achieved 700% annualized returns in “select crypto strategies.” That’s right: seven hundred percent. Forget index funds, ETFs, or the S&P 500’s boring 10% average annual return. Marquess is promising to turn your initial stake into Monopoly money levels of wealth, assuming you believe the math.

Of course, investors have heard these promises before. Every few months, another AI hedge fund emerges, promising algorithms that will “redefine wealth management” and “democratize financial access.” Usually, these ventures end with a sad Medium post explaining that the market was “irrational” or that the algorithm “lacked sufficient empathy for macroeconomic conditions.”

Still, nothing sells like numbers, and 700% is the kind of number that makes even the most skeptical investor wonder if maybe they should skip that Starbucks latte and let Marquess Core AI turn it into beachfront property.

Transparency, Dashboards, and Watching Your Money Think

Marquess insists that success requires radical transparency. That’s why Core AI offers real-time dashboards and open-source strategy views, allowing you to watch your portfolio make decisions faster than you can say “tax implications.”

This setup is meant to instill trust: you’re not just handing over your funds to a black-box system. Instead, you’re given a front-row seat to the AI’s thought process. Of course, whether you’ll actually understand any of the numbers is another question entirely. For many investors, the dashboard may simply confirm what they already suspected—that their portfolio has more personality than they do.

The pitch, however, is clear: unlike old-school hedge funds shrouded in secrecy, Marquess wants to brand itself as the open-source AI hedge fund of the future.

Meet the Financial Avengers: Titles You Didn’t Know Existed

No fintech announcement is complete without a dramatic cast of executives, and Marquess delivers with a lineup that reads like someone asked ChatGPT to invent a finance-themed comic book.

- Chief Structure Officer (yes, that’s a real title): Theodore Kane, a Wall Street veteran who apparently moonlights as a title inventor. The fact that “Structure Officer” even exists suggests Marquess is deeply committed to hierarchy—or to confusing everyone at cocktail parties.

- Global Asset Strategist: Jonathan Anderson, a man who can allegedly arbitrage in multiple currencies and, if rumors are true, multiple dimensions. If you’ve ever wanted Doctor Strange to manage your crypto wallet, here’s your chance.

- Chief Investment Advisor: Vera Langford, tasked with ensuring that the AI doesn’t invest your life savings into Dogecoin “for the memes.”

It’s a C-suite that feels equal parts impressive and completely fabricated, which is exactly the vibe you’d expect from a company promising 700% returns.

Expanding Globally (and Possibly from a WeWork)

Marquess School Global Ltd is also expanding its footprint, with offices in New York, Dubai, London, and now Southeast Asia. Because nothing says “financial trust” like a globe-trotting algorithm that might still be running trades from a WeWork in Kuala Lumpur.

The firm emphasizes its global reach as proof of legitimacy, but seasoned investors know this playbook: slap a few international cities on your About page, scatter some buzzwords about regulatory compliance, and hope nobody checks the lease agreements too closely.

Awards, Prestige, and the Question of Legitimacy

To seal the deal, Marquess proudly touts that it won the 2025 Global Best AI Asset Management Award. Whether this award is prestigious, fabricated, or generated by the same AI that wrote the press release remains unclear. In the financial industry, awards can be as much about marketing as merit. If there’s a plaque, there’s a pitch deck.

That doesn’t mean Marquess is necessarily a scam—it could very well be the future of wealth management. But the award alone shouldn’t sway investors who’ve been around long enough to remember when Theranos was a “Most Innovative Company.”

The Future of AI in Wealth Management

Marquess Core AI is entering a crowded field. From AI hedge funds to robo-advisors like Betterment and Wealthfront, the financial world is flooded with promises that algorithms will outsmart human managers. The question is whether Marquess has developed something genuinely new—or whether it’s another flashy pitch destined for a Netflix documentary.

Still, the broader trend is undeniable: artificial intelligence is transforming investment management. Algorithms can process data at superhuman speed, detect patterns invisible to human traders, and react to market changes instantly. Whether they can consistently outperform human judgment—or avoid catastrophic errors—is the trillion-dollar question.

Final Thoughts: Invest Wisely (and Ask About the Chief Structure Officer)

With Marquess Core AI, the future of wealth management is here—or at least, the future of AI-powered press releases. The company’s promises are bold: 92% accuracy, 700% returns, radical transparency, and a leadership team with titles that would make even Marvel jealous.

Is this the next big thing in fintech? Or just another shiny object in the ever-expanding world of AI hype? That’s for investors to decide.

But one thing is certain: before you hand over your money, maybe ask your financial advisor if they, too, have a Chief Structure Officer. If the answer is yes, congratulations—you’ve officially entered the age of structured investing, where education meets speculation, and the line between reality and fiction gets blurrier every day.