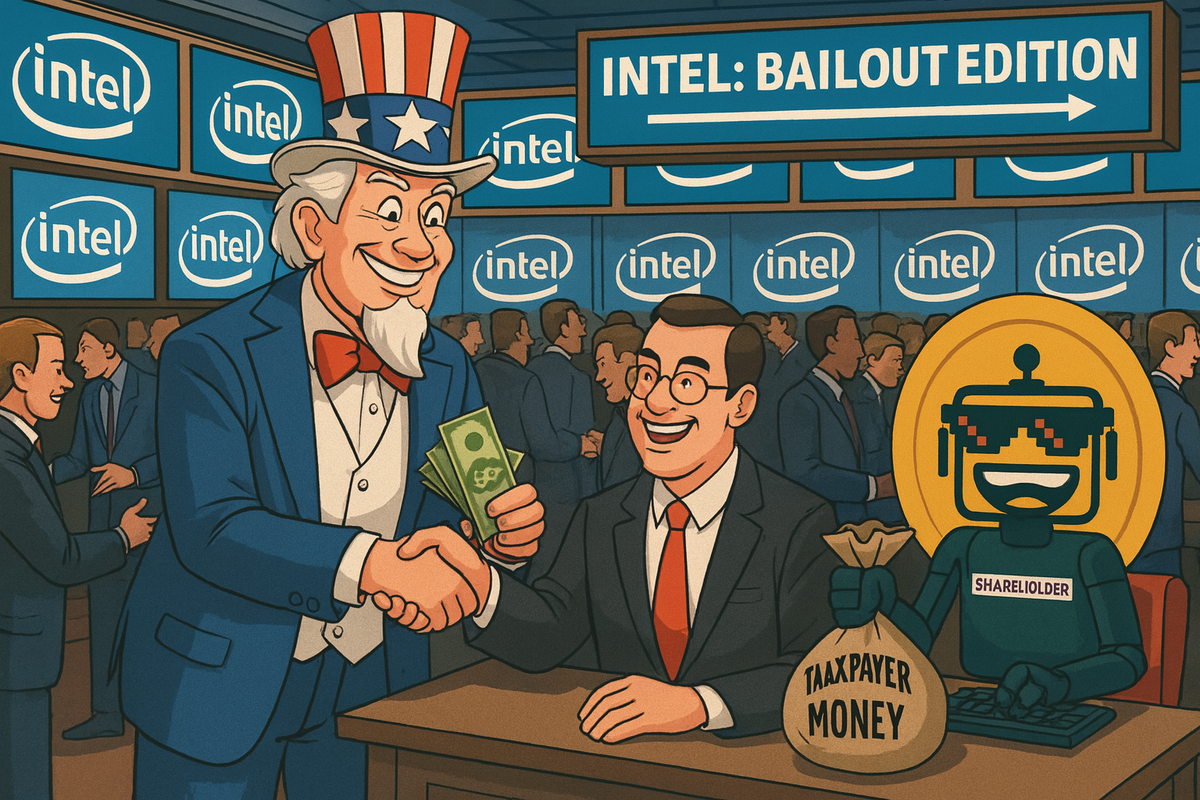

Taxpayers Now Own a Piece of Intel—Enjoy Your Discounted Shares of Mediocrity

Intel and Trump strike an $8.9 billion deal giving taxpayers a nearly 10% stake in Intel—critics call it a bailout disguised as semiconductor leadership.

Move over Space Force, there’s a new taxpayer-funded venture in town: the U.S. government is now the proud owner of nearly 10% of Intel. Yes, Intel—the chip giant that once ruled Silicon Valley with an iron wafer, only to trip over its own fabs while TSMC and NVIDIA stole its lunch money. Apparently, when your stock price hovers near “grandpa’s retirement portfolio” levels, the fastest way back to relevance is to sell a chunk of your company to Uncle Sam himself.

On August 22, 2025, Intel announced that the Trump Administration will purchase $8.9 billion worth of its stock. The deal is being spun as a historic move to secure America’s semiconductor future. Translation: taxpayers just got roped into buying shares of a company that’s been promising a comeback longer than Avatar sequels.

A Discounted Stake in Mediocrity

The government will pay $20.47 per share for 433 million shares of Intel. That’s a 9.9% stake in the company—close enough to double digits to feel powerful, but not enough to actually do anything. And don’t worry, Washington has promised to be a “passive investor,” meaning no board seats, no governance rights, and no power to tell Intel, “Hey, maybe don’t screw this up again.”

In fact, the government even agreed to always vote with Intel’s board. Because nothing says “responsible stewardship of taxpayer money” like signing a deal where you automatically agree with whatever the company wants. Why not just give the board a rubber stamp that says “Paid for by America” and call it a day?

Intel, the Comeback Tour Nobody Asked For

Intel CEO Lip-Bu Tan assures us that Intel is the only U.S. company still doing “leading-edge logic R&D and manufacturing.” Which sounds impressive until you remember that AMD, NVIDIA, and Apple all rely on TSMC because Intel’s “leading edge” has been dulled since about 2014. But sure, let’s keep throwing billions at the company that gave us the Pentium 4 and those creepy “Intel Inside” jingles.

The press release brags that Intel has spent $108 billion in capital and $79 billion in R&D over the past five years. Yet somehow, they’re still behind. It’s almost like you can’t fix a decade of mismanagement with sheer money alone. But now that the government’s writing checks, surely everything will magically work out.

Enter the Corporate Cheer Squad

As if on cue, a parade of CEOs lined up to shower Intel and Trump with praise.

- Satya Nadella said the Intel–Trump partnership “showcased the best of American ingenuity.” That’s rich coming from Microsoft, a company that just shoved AI into every product like sprinkles on a donut.

- Michael Dell claimed “no company is more important” to U.S. semiconductors. Which is ironic, because most Dell laptops still ship with AMD or NVIDIA graphics that rely on TSMC.

- HP’s Enrique Lores gushed about a “defining moment.” Because nothing defines American innovation like your supply chain depending on a government subsidy.

- AWS CEO Matt Garman said semiconductors are the “bedrock of AI.” No kidding, Matt—though it’s unclear if Intel’s chips are the bedrock or the gravel you pour around the real foundation.

It’s like watching a tech pep rally where everyone knows the quarterback keeps fumbling, but they keep chanting anyway because the boosters just wrote a massive check.

Secure Enclaves and Insecure Returns

Part of this $8.9 billion stake comes from money already promised under the CHIPS Act and the so-called “Secure Enclave” program, which sounds like either a secret Pentagon bunker or a new gated community in Phoenix. Supposedly, Intel will provide “trusted and secure semiconductors” for the Department of Defense. Because nothing instills confidence like chips that require government bailouts before they even ship.

The best part? Previous “claw-back” provisions—where taxpayers might actually get money back if Intel failed—have been eliminated. Permanency of capital, baby! Translation: we’ll never see that money again, no matter how many Xeons catch fire in testing.

The Forward-Looking Statement Olympics

Naturally, this press release ends with a wall of forward-looking statements longer than the Lord of the Rings trilogy. Risks include: Intel might not get the funding, might not deliver on the chips, might face geopolitical conflicts, might fail to retain talent, might ship buggy products, and might generally collapse under the weight of its own promises. In other words: “Please don’t sue us when this turns out to be just another overhyped chip comeback story.”

At this point, why even bother with forward-looking statements? Just write: “Things could go wrong. They usually do. You’ve been warned.”

Taxpayers as Bagholders

The real kicker: this isn’t just an “investment in the future of America.” It’s also a way to eliminate claw-backs, pump Intel’s stock, and give politicians a shiny win to brag about on the campaign trail. Meanwhile, ordinary Americans are now involuntary Intel shareholders. Congratulations, your tax dollars are now parked in a company that can’t even keep up with Apple’s M-series chips.

Yes, technically taxpayers got a “discount” on Intel’s stock. But if history is any guide, that’s like getting 10% off milk right before it expires. The government can exercise warrants for another 5% if Intel loses control of its foundry business, but that’s like getting a free refill of soda at a diner while the kitchen is on fire.

The Bottom Line

Intel and the Trump Administration want us to believe this is the dawn of a new era for American semiconductors. In reality, it’s more like an $8.9 billion Hail Mary pass from a company desperate to look relevant and a government desperate to look visionary.

So congratulations, America. You now own a piece of Intel. Whether that’s a badge of honor or a participation trophy for industrial policy gone wrong depends on how many fabs in Arizona actually make it past PowerPoint.

Until then, enjoy your new role as an Intel shareholder. Don’t spend all those dividends in one place—assuming they ever arrive.